Home equity line of credit amortization excel

You have a credit limit and can withdraw funds from the credit line at your need and convenience. We can also compare the companys credit policy with the competitors on the average days taken by the company from credit sale to the collection and can judge how well a company is doing.

Home Equity Calculator Free Home Equity Loan Calculator For Excel

If the company have an average collection period of 40 days but the company has a credit policy to collect the receivables in 30 days then there is a.

. Auto Loan Amortization Calculator. Amortization Formula in Excel With Excel Template Now let us see how amortization can be calculated by excel. An amortization schedule is a complete table of periodic loan payments showing the amount of principal and the amount of interest that comprise each payment until the loan.

The effective-interest method calculates different amortization amounts that must be applied to each interest expenditure per calculation. Extra Payment Mortgage Calculator - Compares making extra payments to investing. This also increases the chances of refinancing out of a variable rate loan as the equity in the home rises.

Use our amortization schedule calculator to estimate your monthly loan repayments interest rate and payoff date on a mortgage or other type of loan. Smartsheet offers a free home equity loan amortization schedule template for Excel. A couple took an auto loan from a bank of 10000 at the rate of interest of 10 for the period of 2 years.

Unlike fixed-rate mortgages ARM loans will reset at a predetermined length of time depending on the loan program. Paying down more principal increases the amount of equity and saves on interest before the reset period. In the US the Federal government created several programs or government sponsored.

Amortization Schedule - The borrower can view the HELOC amortization schedule. Amortization in excel is Calculated Using Below formula. The CUMIPMT function requires the Analysis.

The HELOC amortization schedule is printable and you can export it to excel or as a pdf file. Where a loan is for a set amount a line of credit is more like a credit card. The simplest of the two amortization methods the straight-line option results in bond discount amortization values which are equal throughout the life of the bond.

Where loans have a set payment each month that accounts for equity and interest a line of credits payment is different each time. A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float. All home equity calculators.

For Excel 2003. Home equity line of credit calculator excel will calculate the payments and show you an amortization schedule for each payment. See how those payments break down over your loan term with our amortization calculator.

Line of credit calculator. Home equity loan and HELOC guide. Current HELOC Balance.

Mortgage lending is a major sector finance in the United States and many of the guidelines that loans must meet are suited to satisfy investors and mortgage insurersMortgages are debt securities and can be conveyed and assigned freely to other holders. Since creating this spreadsheet Ive created many other calculators that let you include extra mortgage paymentsThe most advanced and flexible one is my Home Mortgage Calculator. You can also find a free excel loan amortization spreadsheet by doing a search in Excel after going to File New.

Home equity line of credit HELOC calculator. The mortgage amortization schedule shows how much in principal and interest is paid over time. It is a type of loan in which a bank or financial institution authorizes the borrower to access loan funds as needed up to a specified maximum amount.

A loan amortization schedule for home equity can help you determine the total amount of equity you carry in your home after youve paid on a mortgage for a certain period. Some of them use creative Excel formulas for making the. Home Equity Loan Amortization Calculator.

You enter your current mortgage loan terms and it gives you both a schedule and. A Home Equity Line of Credit HELOC is a line of credit given to a person using their house as collateral. As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability.

Now we have to calculate EMI amount for the same. Calculate the difference in total interest paid on a mortgage loan when making additional monthly payments.

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Mortgage Vs Home Equity Line Of Credit Custom Daily Spreadsheet Drawbridge Finance

Home Equity Loan Amortization Schedule Template Excel Sheet Free Download Free Ebooks Pdf Manual Notes And Template Download

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

Free Interest Only Loan Calculator For Excel

Heloc Calculator

Mortgage Vs Home Equity Line Of Credit Custom Daily Spreadsheet Drawbridge Finance

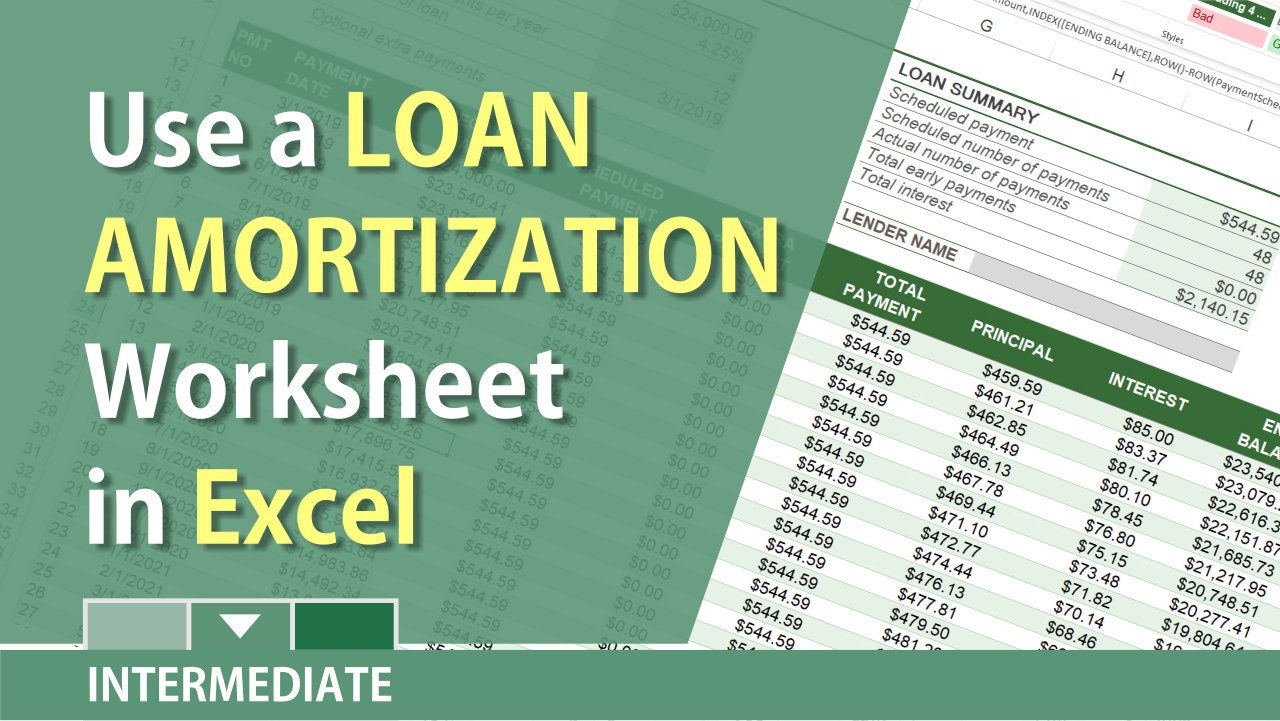

Excel Loan Amortization For New Car New House Or Refinance Chris Menard Training

Home Equity Loan Amortization Schedule Template Excel Sheet Free Download Free Ebooks Pdf Manual Notes And Template Download

Loan Amortization Schedule Calculator Spreadsheet Templates

Home Equity Loan Amortization Schedule Template Excel Sheet Free Download Free Ebooks Pdf Manual Notes And Template Download

Mortgage Payoff Calculator With Line Of Credit

Home Equity Line Of Credit Qualification Calculator

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

![]()

Line Of Credit Tracker For Excel

Home Mortgage Calculator Templates 13 Free Docs Xlsx Pdf Mortgage Amortization Calculator Line Of Credit Mortgage Calculator